Ang Bsp Ay Nagbebenta Ng Government Bonds At Treasury Bills Upang

The book is for sale at P650000. If the client needs cash before the security matures the client can sell the T-bills in the Fixed Income.

Gabay Ng Mag Aaral Ekonomiks Yunit Iii

Alin sa sumusunod ang aksyon ng BSP upang madagdagan ang suplay ng salapi.

Ang bsp ay nagbebenta ng government bonds at treasury bills upang. Patakaran sa Pamumuhunan 30Ang BSP ay nagbebenta ng government bonds at treasury bills upang A. Patakaran sa Pananalapi C. Bibili ng government securities C.

Interest rate is based on prevailing market rates determined during the auction date. Ang mga tenor nito ay in-issue ng 91 days 182 days at 364 days. Ito ang mga GSED na maaring bilhan ng mga government securities tulad ng treasury bills treasury bonds and retail treasury bonds.

BDO Unibank is regulated by the Bangko Sentral ng Pilipinas with contact number 632 8708-7087 and with email address consumeraffairsbspgovph and webchat at wwwbspgovph. Infrastructure and services like health and education. The Government therefore decided to issue debt instruments in the form of bonds and treasury bills.

Dahil ang RTBs po ay government bonds meaning ito po ay direct obligation ng gobyerno sa investors. Key features of the RTBs. Settlement is on the next banking day after the transaction T1.

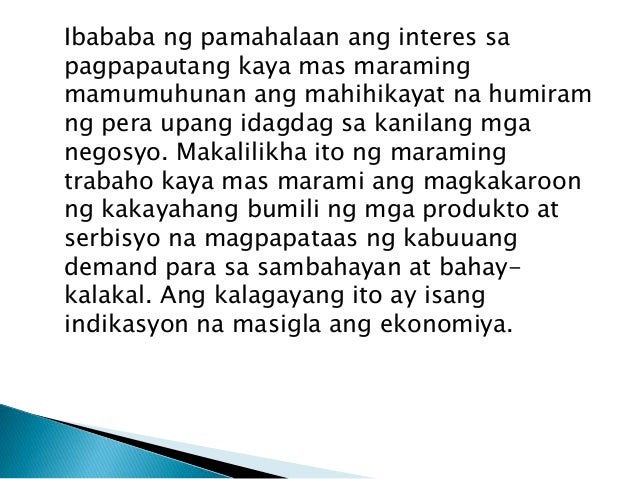

Upang matupad ang mga layuning ito tinatarget ng BSP na magkaroon ng mga tamang lebel ng suplay ng pera ng tamang reyt ng interes at ng tamang reyt ng implasyon. Di-magbago ang salapi sa sirkulasyon 31. The book is penned by renowned Filipino public historian academic cultural administrator journalist author and curator Mr.

The information on this site is intended as a general reference for internet users. GS may be issued in the form of discounted instruments like Treasury Bills T-bills or bonds Fixed Rate Treasury Notes or FXTNs and Retail. GS are issued to finance government spending eg.

Prevailing Market Rate Subject to 20 final withholding tax except for tax-exempt institutions. Treasury bills versus treasury bond. Php 50000000 face value subject to the availability of the security.

Other readings on bonds. Itinaas ang kinakailangang reserba ng. Earns fixed interest rate over the term of the bond.

It is made available on the understanding that The Bureau of The Treasury BTr. Paalala po na ito ay hindi isang endorsement. A government securityies GS is a form of debt issued through the Bureau of the Treasury.

These are issued on a quarterly basis. Dagdagan ang salaping nasa sirkulasyon C. The Bangko Sentral ng Pilipinas proudly launches its latest publication Yaman.

Dagdagan ang salaping nasa sirkulasyon C. 1 91 day 2 182-day 3 364-day. Tapos po sa other matters naman po natin mabuting balita po ang Bureau of Treasury ay nag-o-offer po ng Retail Treasury Bonds or RTBs sa publiko mula July 15 Miyerkules po iyan ng susunod na linggo.

Ang mga securities ay tumutukoy sa bond at treasury bills. The information on this site is intended as a general reference for internet users. Bawasan ang salapi sa sirkulasyon B.

Mapalitan ang salaping nasa sirkulasyon D. Treasury Notes and Bonds FXTNs and RTBs as they are commonly called are medium- to long-term government securities that pay interest regularly known as interest coupon payments. Pagpapatatag ng presyo at paglago.

Ang mga ito ay nagpapatunay ng halaga ng pamumuhunan ng isang tao at ang makukuha niyang kabayaran mula sa pamumuhunan sa bonds. 30Ang BSP ay nagbebenta ng government bonds at treasury bills upang A. Direct transfer via Kina.

Nagbibigay lang po ako ng impormasyon kung saan makakabili ng government securities. Nakuha ko ito sa sa website ng Bureau of Treasury. Mapalitan ang salaping nasa sirkulasyon D.

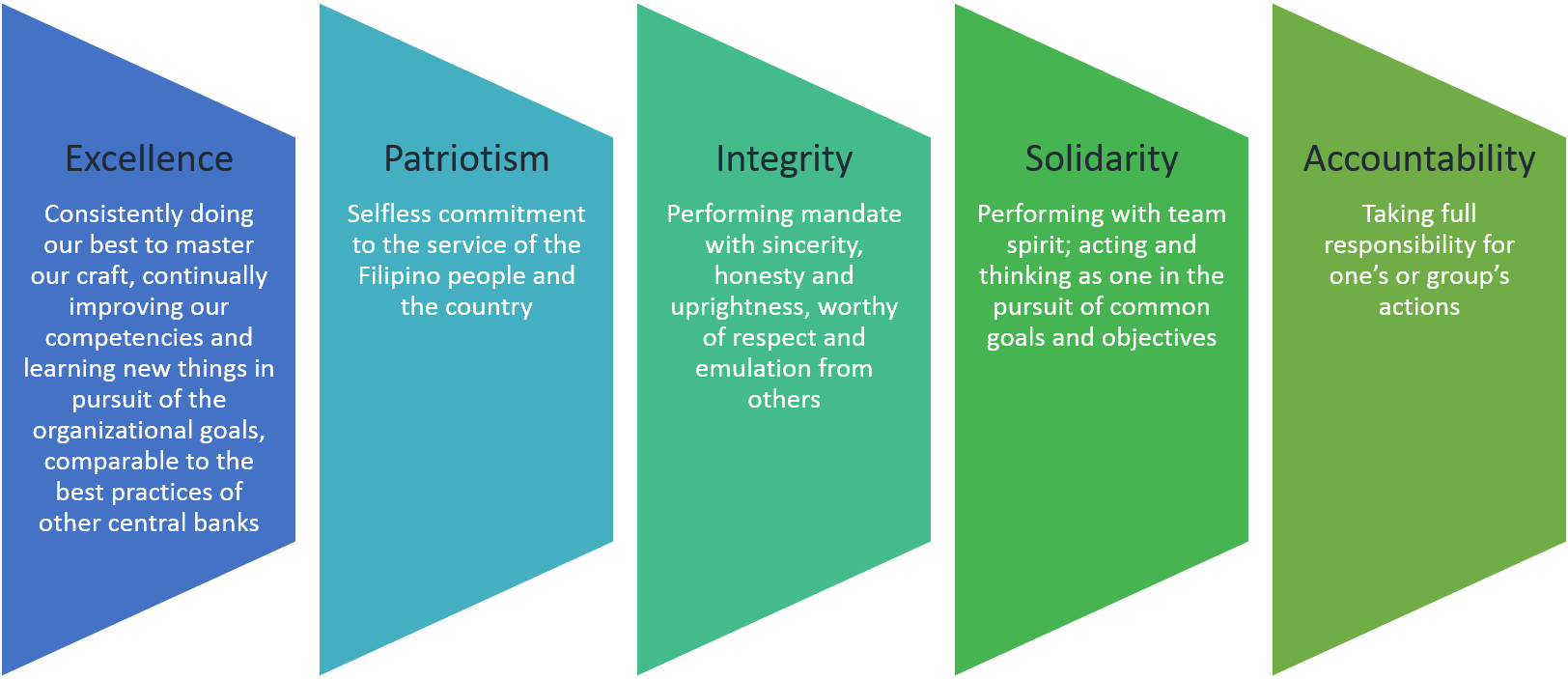

Layunin at Patakarang Pananalapi -Batay sa mandato nito maaaring uriin ang mga layunin ng BPS sa dalawa. At par or 100 of face value Interest Rate. History and Heritage in Philippine Money The Numismatic Collection of the BSP.

This is for you. All settlements to be effected on Fridays within 2 4 days of lodging T2 3 4 Payment Mode. In March the Monetary Board authorized the Bangko Sentral ng Pilipinas BSP to purchase government securities from the Bureau of the Treasury BTr under a repurchase agreement in the amount of.

Ibinebenta ang mga treasury bills at a discount rate base sa kaniyang face value. Bawasan ang salapi sa sirkulasyon B. Monday Friday 1000am to 200pm.

Halimbawa ang face value ay PhP1000 at ang rate ay 5 mabibili mo sa offer. It is made available on the understanding that The Bureau of The Treasury BTr. Treasury bills ang tawag sa mga government bonds na magma-mature within one year.

Ay mga substitute ng salapi. Di-magbago ang salapi sa sirkulasyon 31. Philippine Government through the Bureau of the Treasury BTr Tenor.

The government is set to borrow P195 billion from domestic sources through the issuance of Treasury bills and Treasury bonds in the third quarter the Bureau of the Treasury said yesterday. The BDO BDO Unibank and other BDO-related trademarks are owned by. To assist in this growth First National Bank Botswana offers customers an opportunity to invest in Botswana Government issued Bonds and Treasury Bills.

This is a relatively risk-free investment as these are direct obligations of the Republic of the Philippines denominated in the local currency. Retail Treasury Bonds RTBs form part of the National Governments program to make government securities available to retail investors especially individuals.

Pinoy Numismatist Network Home Facebook

Bangko Sentral Ng Pilipinas About The Bank

Belum ada Komentar untuk "Ang Bsp Ay Nagbebenta Ng Government Bonds At Treasury Bills Upang"

Posting Komentar